Anti-crisis shield: co-financing of salaries from the guaranteed employee benefits fund (“fund”) (art. 15g) vs district governor (art. 15zzb)

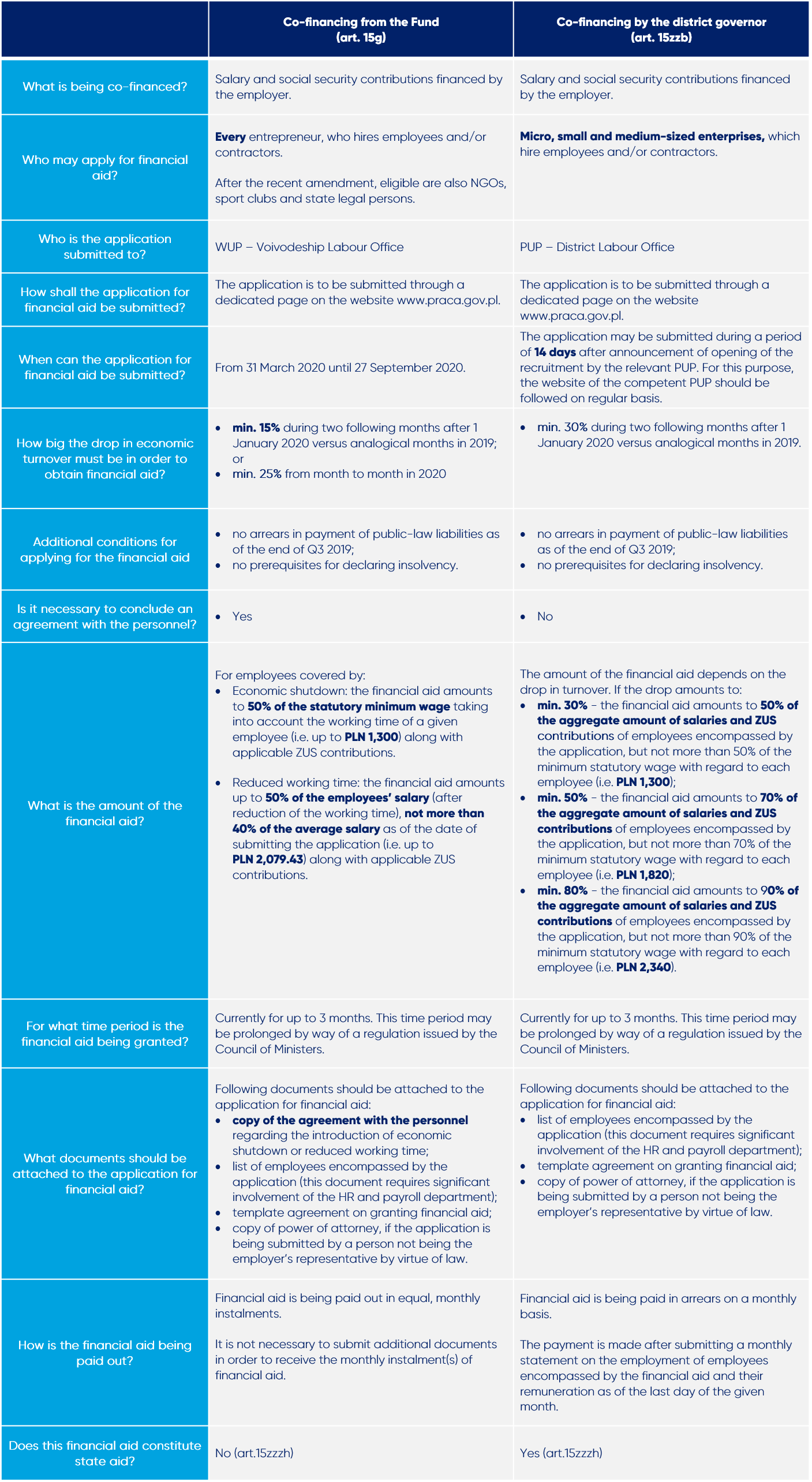

Entrepreneurs who have suffered a drop in turnover due to COVID-19 may apply for co-financing of the salaries of their employees from basically two sources:

- From the Fund based on art. 15g of the Anti-Crisis Shield,

- By the district governor based on art. 15zzb of the Anti-Crisis Shield.

Based on the content of the template applications for co-financing of salaries and the statements of the Ministry of Labour and Social Policy and of the local labour offices, these benefits may not be applied for jointly in relation to the same employees. In our opinion, this position is not in line with the provisions of the Anti-Crisis Shield; however, we are aware that the so-called “clerical law” is currently of huge importance for the purpose of quickly and efficiently obtaining co-financing of employees’ salaries.

Therefore, it is important to consider all aspects and choose the most suitable solution for the concrete situation of a particular beneficiary/applicant.

Given the aforesaid, we have prepared for you a brief comparison of selected terms and conditions of financial aid from both of these sources. We hope that this will be helpful for you.

If you have any additional questions or would like to see if you can combine the two types of financial aid in practice, please do not hesitate to contact us.