European Commission announces plan to break away from Russian gas by 2030. Apart from supply diversification unlocking RES potential as a remedy

In response to Russia’s invasion of Ukraine, apart from the sanctions imposed on the aggressor and Germany’s suspension of Nord Stream 2, the European Commission announced a strategy to quickly make the EU independent of Russian gas supplies. Equally, new sources were identified to replace lost volumes. The communication emphasises the importance to the EU’s energy security of swiftly removing dependence on Russian fuels, while keeping in mind ambitious climate goals. There is also a strong focus on maintaining price and gas storage stability in the EU. SSW Pragmatic Solutions, a law firm recognised by Legal 500 in the Global Green Guide 2022 category, summarises the most important aspects of the adopted strategy. We also indicate what legislative actions can be expected in Poland in the near future.

The REPowerEU plan, announced by the Commission last week, calls for a quick transition from Russian supplies of raw materials by 2030. This target is extremely ambitious considering that, currently, around 45% of the EU’s total gas and coal imports come from Russia. Similarly, the greatest amount of oil imported into the EU is Russian oil (27%). As a first step, the Commission presented the strategy to replace Russian gas supplies as a challenge requiring the greatest effort by the Member States.

The Commission has calculated that 155 billion m3 of gas obtained from Russia by 2030 can be fully replaced by implementing two pillars:

- diversification of gas supply;

- accelerating the transition to renewable energy sources.

“REPowerEU is our plan to break our dependency of Russian gas and define freedom on our energy choices. All we need is the courage and grid to get us there. If ever there was a time to do it, it is now.” –Frans Timmermans, Executive Vice-President of the European Commission, 8 March 2022, Brussels

DIVERSIFICATION OF GAS SUPPLY AND SUBSTITUTION OF NATURAL GAS

The Commission indicates that the implementation of the REPowerEU plan could already lead to a reduction in EU gas demand by the end of the year, at an amount equivalent to two thirds of last year’s imports of Russian gas. Further measures are to include in particular:

- changing the directions of gas imports, e.g. transport via existing pipelines from Azerbaijan, Algeria and via the completed Baltic Pipe;

- increasing the supply and development of the LNG infrastructure – the potential destinations include the United States, Qatar, Egypt, Korea, Japan and even Nigeria, Turkey and Israel;

- increasing production of biomethane –production should increase to 35 billion m3 per year thanks to additional support schemes to construct biogas plants, which should finally provide the economic justification for making difficult investments such as large biogas plants to turn biomethane into a substitute for natural gas in the gas distribution network;

- accelerating the use of hydrogen – up to 50 billion m3 of imported Russian gas is expected to be replaced by hydrogen; interestingly, the Commission does not rule out the use of nuclear energy.

ACCELERATING THE TRANSITION TO RES

However, replacing natural gas with hydrogen and methane will not be enough. The Commission has placed particular emphasis on accelerating investment in the RES sector, including large-scale projects. The barrier identified by the Commission is that the permitting process is complicated and time-consuming. At the household level, the pace of installing PV panels on roofs is to be accelerated and home furnaces are to be replaced by heat pumps.

The Commission expects the following actions from the Member States:

- for large installations:

- simplification and reduction of time required to issue permits;

- planning measures to secure adequate land and sea areas available for renewable energy projects;

- promoting entrepreneurs’ access to cPPAs;

- for home and building energy:

- lowering the thermostat settings for building heating by 1 °C;

- accelerating the installation of photovoltaic panels on roofs –up to 15 TWh per year;

- accelerating the implementation of heat pumps by doubling the installation rate, which will bring the total to 10 million units over the next 5 years.

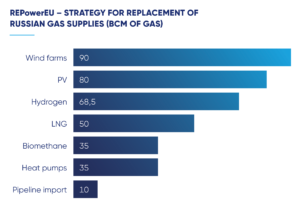

The graph below shows in figures the opportunities offered by the implementation of the EU REPowerEU strategy.

Source: own study based on European Commission Communication COM (2022) 108.

* All figures are estimates and maximum predicted values are given, using billion cubic metres of gas as the unit of measurement. The figures represent the sum of the Fit for 55 targets and the values over and above those resulting from REPowerEU.

As a result of the above proposals, the European Commission announced a number of actions which, in agreement with the Member States, aim to enable the realisation of the REPowerEU strategy. Among them, the following announcements deserve special attention:

RES:

- Developing recommendations to ensure the swift permitting of renewable energy projects and the use of existing flexibility mechanisms and methods to remove impediments, regardless of their origin. The publication of the recommendation is scheduled for May 2022;

- Concluding the guidelines on financing mechanisms best suited to promote the development of power purchase agreements (cPPAs) in Europe by the Commission, in cooperation with the EIB Group. The guidelines are expected to be ready by the summer. New consumers such as SMEs are to be given incentives to access to cPPAs;

- Communication on solutions to accelerate the roll-out of rooftop PV systems (June 2022);

- Issuing guidelines on the need to use sandboxes, meaning legal environments for testing innovative technologies, products or services in the area of RES (May 2022);

HYDROGEN:

- Creating a regulatory framework to promote the integration of gas and hydrogen infrastructure and the construction of hydrogen storage facilities and port infrastructure. The new cross-border infrastructure should be entirely adapted for hydrogen usage. State aid notifications for hydrogen projects are to be most highly prioritized. By the summer, each of the submitted Projects of Common Interest (PCIs) are to be reviewed;

- Supporting partnerships for green hydrogen production and transportation. Developing pilot programs;

- As an additional announcement, in contrast to the dedicated funds envisaged by the Hydrogen Strategy (InvestEU, InnovFin), to establish an entirely new Global European Hydrogen Facility to ensure access to affordable renewable hydrogen throughout the EU;

BIOMETHANE:

- Recommending that Member States implement in their Common Agricultural Policy strategic plans the financing of biomethane produced from sustainable biomass sources, in particular from agricultural waste and residues;

- Establishing a support system for agricultural biomethane plants.

AID TO ENTREPRENEURS IN CONNECTION WITH RISING ENERGY PRICES. SUPPORT FOR ENERGY-INTENSIVE BUSINESSES

The European Commission drew attention to high energy prices, which harm the economy, and outlined possible mechanisms to support industrial customers and final customers..

The Commission clearly indicates that temporary aid to companies affected by price rises, irrespective of their size, should be allowed under the Rescue and Restructuring Guidelines[1]. It also reiterated the compatibility with EU law of supporting particular sectors at risk of carbon leakage because of indirect emission costs under the EU Emissions Trading System (EU ETS). The recently amended list of compensated sectors may be expanded as a result of EC intervention.

The Commission is considering an alternative emergency framework to allow liquidity support to be provided to all companies directly or indirectly affected by increased energy prices following Russia’s invasion of Ukraine, especially as regards additional compensation for energy-intensive consumers.

Additionally, the Commission announced an accelerated implementation of call for proposals for the Innovation Fund, including by expanding its scope to include a two-way contract for difference called Carbon Contracts for Difference (“CCfDs”). The CCfDs mechanism would be a support system that guarantees an allowance price at a certain level to ensure a predictable return on investment to reduce GHG emissions.

SECURING GAS STORAGE

The Commission also recognised the problem of ensuring sufficient gas supplies. In April, a legislative proposal seeking to ensure the sufficiency of gas storage every year, will be ready. Most importantly, gas storage facilities will be given the status of critical infrastructure, resulting in their protection and enabling additional funding for investments in this area. Member States will be entitled to grant aid to gas storers, i.e. through a two-way contract for difference.

SSW PREDICTION

The REPowerEU strategy should give a new impulse to the Polish Parliament, especially as regards supporting investments in renewable energy sources, hydrogen and biomethane. The Commission shows that remedying the EU’s current dependence on Russian gas supplies will not come only from LNG and the Baltic Pipe. The energy transformation will not happen without an improvement in the RES sector. Investors are especially waiting for the liberalization of the 10H Act, which continues to hinder investments in wind farms and contradicts the EU’s stated strategy in this regard. The announced promotion of cPPAs among small and medium-sized enterprises is a promising step towards engaging businesses in the transformation. The announced simplification and acceleration of procedures regarding investment locations and issuing permits gives investors, many of whom are concerned about the upcoming zoning reform, another weapon to fight for flexibility in any new statutory law, to avoid years of stagnation while waiting for local plans to be developed.

Authors: Dominik Strzałkowski, Maximilian Piekut with cooperation: Michał Ilasz

[1] The aid may be granted for a maximum period of 6 months in the case of large enterprises in difficulty or a maximum period of 18 months in the case of SMEs.